Planning To Buy New Jewel? Expert Advice On How To Strike Best Deal May 14, 2018 – Posted in: Blog, How To – Tags: #tipstobuygold

When it comes to buying jewellery, gold is undoubtedly the most preferred metal in India. It is durable and lasts indefinitely if taken good care. For Indians, this yellow metal symbolises purity, prosperity, happiness and wealth and is therefore an indispensable part of our tradition and rich cultural heritage. This rich metal is not just a fashion accessory but also a protective shield against inflation and sinking markets. Another benefit of buying gold is that it is a great investment option for many as it retains its value and can be liquidated easily.

Since gold is quite expensive, it is important to know thoroughly about gold and buying gold jewellery to avoid being fooled by sellers. Whether you are buying gold jewellery for special occasions, to gift others or to make an investment, keep the following key factors in mind when you go shopping for it.

1. Purity

The purity of gold is measured in Carats, which is denoted by a capital letter ‘K’. A ‘24 Carat’ or ‘24K’ gold is 99.9% pure whereas a ‘22 Carat’ gold is 92% pure. Since every Carat of gold is equivalent to 4.2% of pure gold, therefore, ’14K’ of gold will have 58.33% of pure gold.

Gold in its purest form (100%) is too soft to use to make jewellery. To make it strong, durable and apt for making jewelleries, it is alloyed with different metals such as zinc, nickel, copper and silver. For purchasing jewelleries, the most common ‘Carat’ options are 18K, 22K or 24K.

When purchasing gold jewellery, always check for its purity and asking the dealer will not work as he/she may be trying to fool you. The easiest way to check purity of gold is to look for BIS standard mark as it is an indication of purity of the gold. The BIS hallmark or Bureau of Indian Standards hallmark certifies the purity of both gold as well as silver jewelleries sold in India. The mark assures the purchasers that the piece of ornament conforms to a set standards laid by the BIS or Bureau of Indian Standards, the national standards organization of India. Therefore, it is advisable to avoid buying jewellery pieces that are not hallmarked even though they are available at cheap rates.

Explore More: https://www.augrav.com/blog/difference-between-14k-18k-22k-and-24k-gold-jewellery

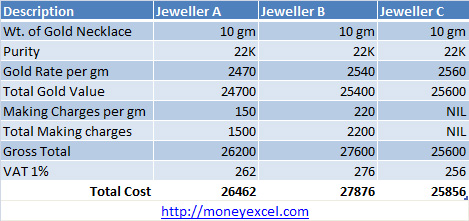

2. Gold Rates

Gold rates vary because of the two prominent reasons, which are listed as follows:

Purity of Gold: This requires no brains that 24K gold will be costlier than 22K gold.

Location: not many people know that but gold rate is not uniform throughout India. It varies from one city to another.

Before going to a gold jewellery store, always check the per gram rate of gold. Doing so is important as it firstly not only helps you calculate the estimated cost of your purchase but also saves from fraudsters who quote gold prices high at the time of sale. It is advisable to search for gold rates on the day you’re going to make the purchase as yesterday’s gold prices may not be applicable today. You can search for gold rates on the internet or check with renowned gold jewellery showrooms.

Explore More: https://www.augrav.com/gold-rate-in-chennai

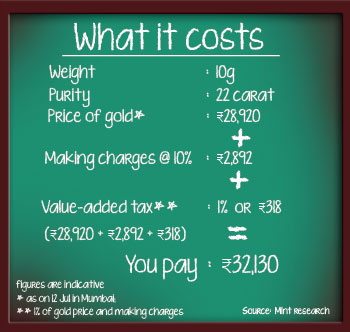

3. Making Charges

Making charge is one of the components that constitute the final price of the purchase. It is the labour charge involved in creating final piece of jewellery. Whether you buy a heavy necklace or a small pendant, making charges are associated with every piece of jewellery. The making charges may depend on the following few factors:

The type of jewellery: A bridal choker set requires more work than a simple chain set. Therefore, the former will cost more than later.

The design of jewellery: An intricate design requires more precision and therefore more expertise and charges to do the job.

Man-made and machine-made: The making charges of machine-made jewellery are lesser than of man-made jewellery.

The seller of jewellery: Making charges also depend on the seller. A brand will charge more than a local gold jewellery store.

Explore More: https://www.augrav.com/blog/interesting-ways-to-customize-platinum-rings

4. Weight

The weight of gold is measured in grams (gms). When you go to purchase gold jewellery from a seller, you will notice that every piece of jewellery has its weight (in gms) tagged with it. The cost of the gold jewellery will increase with the increasing weight. Since jewellers weigh a piece of jewellery in its entirety, therefore, precious stones such as diamond and emerald are often added thus increasing the weight as well as cost of the gold jewellery in the process. Therefore, if you’re buying gold jewellery for investment, try to avoid designs that have precious stones added to it otherwise you’ll end up paying for gold which is not even there.

Also Read: https://www.augrav.com/blog/5-reasons-you-should-buy-gold-coins-from-augrav-this-diwali

5. Buy-back Terms

Gold is an excellent investment option, which gives you returns better with passing time. However, this investment will be fruitful only if the seller from whom you purchased jewellery will give you a buy-back option. Although most jewellers nowadays give buy-back gold option to their customers at prevailing rate still it is better to always check with your jeweller, if he/she is willing to provide buy-back gold option to you if you ever decide to encash or exchange the last purchase with more recent design. You must also enquire about the exchange and buy-back period and policies if there are any.

Also Read: https://www.augrav.com/blog/wow-them-with-a-gift-that-theyll-love-jewellery-gifts-for-every-hobby

6. Bill

Bill is another important factor to consider before buying gold jewellery from a jeweller. Always ask for an electronic bill instead of an unauthorised receipt due to the following reasons:

An electronic receipt includes all particulars of a transaction whereas an unauthorised bill is made by sellers to save taxes.

Since an electronic receipt is printed, therefore, it cannot be forged but the same cannot be said for unauthorised receipts.

Electronic bill gives assurance of authenticity and transparency of information to customers with printed transaction number, seller’s stamp, and other such small details. On the other hand, nothing as such is present on an unauthorised receipt.

If you ever in future decide to exchange or encash a piece of jewellery, it will be easy to do so if you will have an electronic receipt. But with an unauthorised receipt if you try to encash the jewellery, the jeweller will deduct certain amount due to unavailability of an electronic receipt.

In case you have no other option but to approach consumer court, an electronic receipt will be more authentic as a proof then an unauthorised receipt.

Therefore, even though you will have to pay GST (goods and services tax), buy gold jewellery only from jewellers that give electronic receipts.

Also Read: https://www.augrav.com/blog/the-most-valuable-corporate-gifts-that-your-employees-will-love