8 Factors that Affect Gold Rates in India June 18, 2018 – Posted in: Blog, General – Tags: FactorsAffectingGoldRate

Gold is deeply rooted in Indian culture. Its demand is driven by religion, traditions, festivals and other important family and societal occasions. Moreover, the metal is a reliable investment option which can be easily liquidated at the time of financial crisis. Since India is one of the world’s largest gold jewelry consumers, even the slightest variation in its rates internationally can have considerable effect on gold rates in India. But having said that, global market is not the only factor that influences gold rates in India. There are other factors too that determine the price of gold. Some of them are discussed as follow:

1. Geo-political Events

Gold rates are correlated with geo-political tensions. Whenever there is an actual tension or speculation of strain in international relations, especially if it includes major nations such as U.S., the gold rates rise. This is because at the time of rising tensions, investors run towards gold due to the metal’s quality to preserve its value even in turbulent times. In addition to this, the yellow metal does not involve counterparty risks and is highly liquid, making it ideal to be called as a ‘crisis metal’.

2. Government Actions and Policies

Government policies and actions of major economic players such as China and U.S can have direct or indirect influence on gold prices across the world. Especially, change in the import-export policies of major gold producing and consuming countries can significantly impact gold rates across continents. For instance, India introduced Sovereign Gold Bonds and Gold Monetization Scheme as a substitute to physical gold to discourage investors in buying physical gold. As the demand for physical gold decreases and the supply remains constant, the gold rates are expected to witness a decline.

3. Change in Currency Value

The value of Indian currency with respect to the value of gold exporting countries’ currencies influences gold rates in India. In case the value of Indian Rupee (INR) drops with respect to the value of let’s say US Dollar, the price of importing gold into the country increases. This in turn will increase the gold rate in India. Similarly changing currency valuations of other gold exporting countries too can impact gold rates.

4. Gold Reserves

Each nation has its own gold reserve, which is managed by central banks of those nations. Whenever countries borrow money by issuing government bonds and securities, these reserves then help in assuring creditors that they will receive what is due to them. When required, the reserves come to rescue and help countries make payment to their creditors. For instance in 1991, India raised $405 million by pledging 46.91t of gold to avoid defaulting on payments.

Decisions made by a nation’s central bank regarding their reserved gold can impact gold rates. In India, gold reserve is managed and regulated by the Reserve Bank of India (RBI). So if RBI revises its gold reserve policy, the decision might affect gold rates in India.

Furthermore, when central banks of major countries hold gold reserves, the rates of the yellow metal go up. This is because the supply in the market decreases while the cash flow increases. Similarly, putting reserved gold in the market causes gold rates to fall.

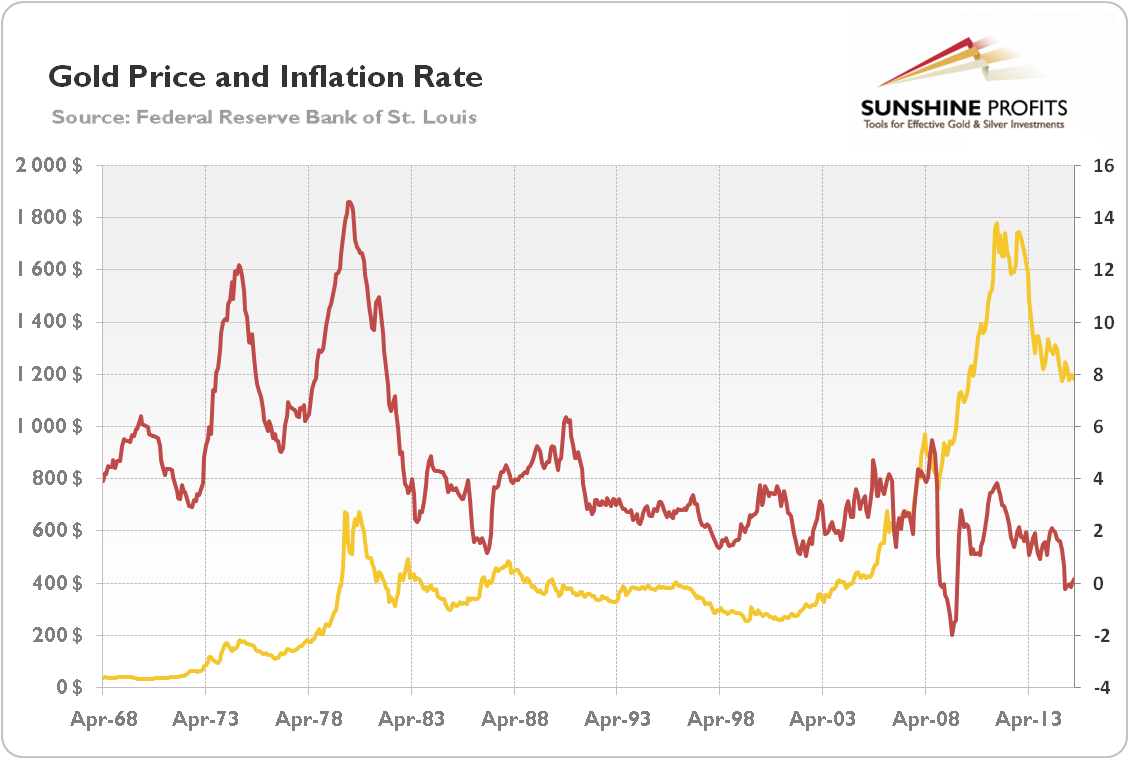

5. Inflation

For Indians, Inflation is an old and regular issue, the rate of which has been increasing to 10 per cent and above since 1980. Given that gold is the best bet to use as a hedge against inflation, Indian investors turn towards it to protect their wealth. As a result, when inflation hits, the demand for gold goes up in the market, which further causes gold rates to increase.

6. Demand and Supply

World economics run on demand and supply chain. With the increase in the demand for gold, its rates rise. In India, the demand of gold is largely in the form of ornaments. As per the reports published by WGC, in 2010, jewelry alone accounted for around 54 per cent of the total gold demand in the world. Besides being used in the form of ornaments, the metal is also used for various other purposes such as in electronic devices, medicines, aerospace, etc.

Since gold is considered auspicious in India, therefore, its demand is usually at peak in the months of October and November. This is because in these months people celebrate Diwali (one of the most celebrated festivals in India) and the wedding season is about to begin. Akshaya Trithiya, celebrated in late April or early May, is another auspicious occasion on which buying gold is considered propitious. The rise in demand during these months of a year again leads to substantial increase in gold prices.

Another important point to note about the gold ornaments demand-supply in India is that the gold prices in the country are not uniform across all cities. This is because of various factors such as gold associations and regional and demographic differences. The southern states of India dominate the nation’s gold ornament consumption, which accounts to nearly 40 per cent of the total volume.

7. Gold Production

Since gold is a scarce natural resource, its production is tied to its availability. The world’s gold production also influences the cost of all gold globally. Everyone knows that gold is a scarcely found natural resource. The amount of gold produced in a year is lesser than the amount of gold supplied in a year. One of the prime reasons of this is that all the “easy gold” has already been mined. To fulfil the world’s gold demand, miners have to now dig deeper and in very specific parts to get the quality gold reserves. Since gold is now even more challenging to access, a lot of money will be spent to take out a small amount of gold. When the gold production costs rises, miners sell gold at higher rates to preserve their profits.

8. Income

According to the WGC, rising incomes in India has a positive impact on the gold demand. For a 1 per cent rise in income, per capita gold demand rises by 1 per cent. The rise in demand further impacts gold rates in the market even though insignificant.